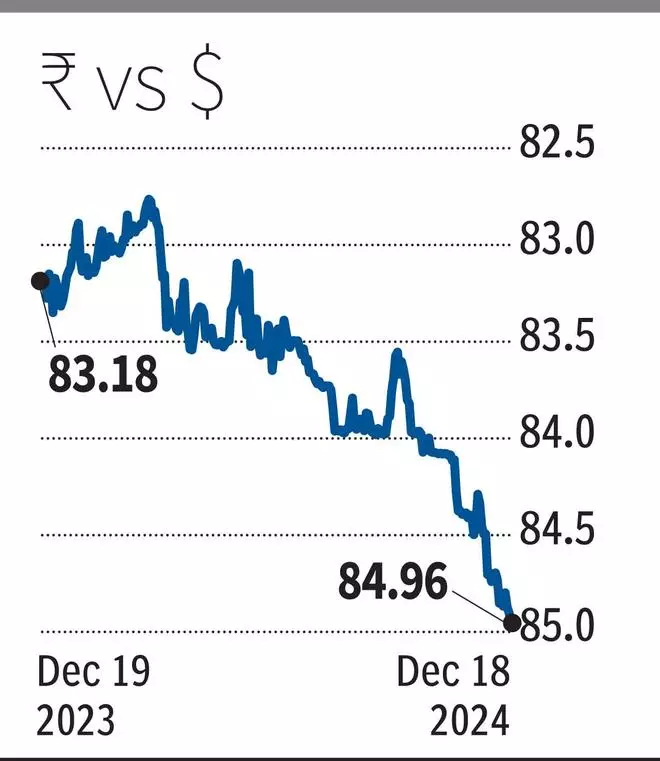

Rupee (INR) seems to be gradually weakening towards 85 per US dollar (USD). The domestic unit closed at another lifetime low due to a host of factors including a dollar buying spree by importers, withdrawals from domestic equity markets due to net selling by foreign portfolio investors and an all-time high trade deficit in November.

The rupee closed at 84.9525 per US dollar, about 6 paise lower than its previous close of 84.8950, while forex market traders eagerly awaited the US Fed’s decision on a possible rate cut.

Intra-day, INR tested all-time high of 84.9550, with RBI putting brakes on further depreciation by intervening in the market through dollar sales.

Amit Pabari, MD, CR Forex Advisors, said the rupee is under pressure as the Federal Reserve is expected to cut rates. However, market expectations for a rate cut in 2025 have declined due to strong US economic data and potential policy implications related to Donald Trump’s upcoming presidency in January.

“Thus the spotlight is now firmly on the FOMC economic growth projections and dot plots. These estimates…are poised to provide important insight into the Federal Reserve’s outlook. “Although not binding, it serves as a valuable indicator of future rate fluctuations, helping investors gauge whether the Fed’s stance is in line with current market expectations,” he said. Said.

Additionally, the Fed Chair’s comments during the post-policy announcement will be important in shaping market sentiment. Pabari estimates the rupee to trade in the range of 84.70 to 85.20 in the near term.

asian currencies

V Rama Chandra Reddy, head-treasury, Karur Vysya Bank, stressed that the RBI still has the ability to intervene in the market, noting that it has built up foreign exchange reserves for tough days. Therefore, in the last one and a half month, the rupee has not depreciated against the US dollar as much as other Asian currencies including the Chinese yuan.

Asian currencies fell after Trump threatened to raise tariffs on imports from BRICS countries if they issue a common currency for trade.

Reddy said importers are rushing to buy dollars fearing further depreciation of the rupee, while exporters are holding on to realize export earnings in the hope of getting more rupees in exchange for the dollars brought back later.

Radhika Rao, senior economist and executive director, DBS Bank, said with the rupee at a record low, market participants will continue to test the new RBI governor’s outlook on the currency.

“Further Yuan/CNH weakness and the possibility of higher UST (US Treasury) yields also kept pressure on the rupee. Allowing the currency to depreciate would help rein in the import bill, although officials may prefer to keep the resulting volatility under control. Meanwhile, there is also market buzz that RBI’s NDF (non-deliverable forward) short position has almost halved from the earlier rumored $60 billion. DBS FX strategist sees the rupee depreciating beyond 86 per dollar over the next three months and 12 months.