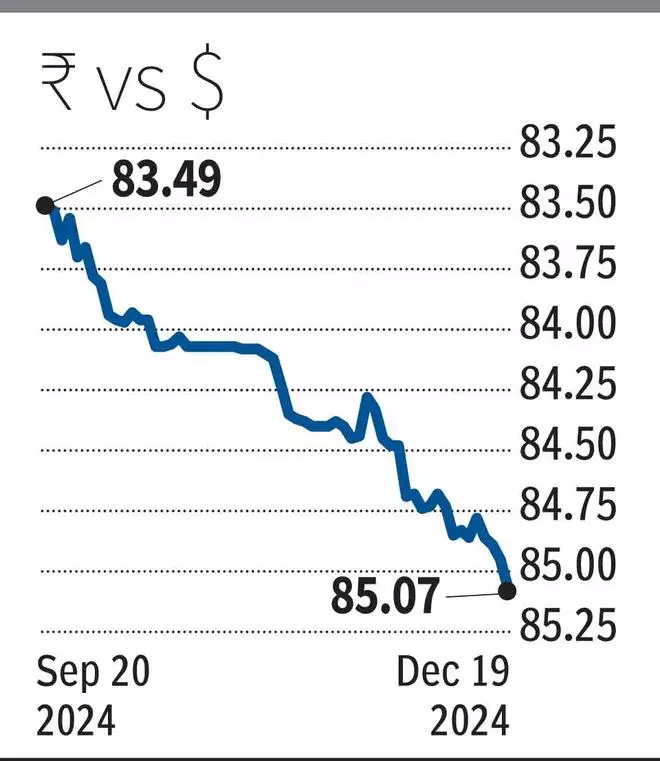

from india Rupee The US dollar on Thursday breached the 85-per-dollar level, hitting an all-time low, mainly due to the US Fed’s dovish stance, higher outflows from domestic equity markets and other global uncertainties, senior bankers said. Went.

“Dialed back in US Fed rate cut expectations for 2025 has increased US dollar strength and resulted in depreciation pressure on emerging market currencies like INR. Sakshi Gupta, principal economist at HDFC Bank, said the interest rate differential between the US and India is likely to be smaller than before, which will worsen the rupee’s outlook for 2025.

CR Forex MD Amit Pabari said expectations of a US Fed rate cut for 2025 strengthened the dollar, pushing the US dollar index to 108.27 and US 10-year yields to 4.52 per cent, attracting capital from emerging markets. The outflow has started.

Domestically, India’s Q2 gross domestic product He said the growth rate also slowed to 5.4 percent, while inflation increased to 6.21 percent and the trade deficit reached $37.8 billion. reserve Bank of IndiaThe stability-focused stance evoked mixed reactions, while limited liquidity hampered intervention efforts.

Bank of Baroda Chief Economist Madan Sabnavis said high trade deficit and volatile FPI flows at the fundamental level have pushed the Indian currency down. A strong US dollar and a potential Trump policy package are weighing on the currency, he said.

Kunal Sodhani, vice president, Global Trading Center, Shinhan Bank, says various factors, including outflows from domestic equity markets, overall strength of the US dollar due to the US Fed’s dovish stance and uncertainties prevailing due to Donald Trump, create arbitrage opportunities in between. Are included. Onshore and offshore rupee markets, and weakening of Asian currencies – especially the Chinese yuan – are all putting pressure on the Indian rupee.

“India’s forex reserves are depleting due to FCA revaluation and intervention shows that there is no further force visible in the direction of sharp appreciation, even if the rupee appreciates to some extent, the RBI is likely to keep the numbers very high. Keeping this in mind one can expect to build foreign exchange reserves. Uncertainties abound for the year 2025,” he said.

Outlook

According to Pabari, the rupee may face further weakness due to panic in the stock markets and increasing global pressure. In the near term, USD/INR may move towards 85.20 levels, with Trump’s upcoming tariff policies set to shape future market dynamics.

Shinhan Bank’s Sodhani believes that, situationally, the level of 84.60 now acts as a strong base for the Indian Rupee, while the door is open for the level of 85.50. Meanwhile, Gupta says the rupee could fall to 86.50 levels by the end of 2025 as the US dollar remains strong and foreign inflows remain volatile due to policy uncertainty in the US.

According to Soumyajit Niyogi, director of India Ratings and Research for India, while the current account deficit is expected to be around 1.1 percent of GDP, the Indian rupee is expected to weaken 3 percent to 86.9 in fiscal 2026.