The real estate sector has contributed about one-sixth of the amount raised Qualified Institutional Placement (QIP) This year.

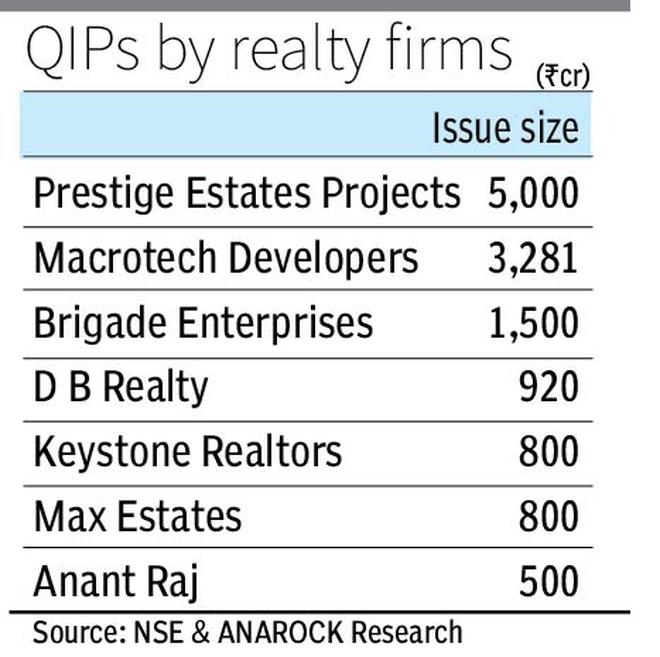

Data compiled by ANAROCK Research shows that of the ₹75,923 crore raised through QIP till September, 17 per cent or ₹12,801 crore was by realty companies.

Prestige Estate Projects, Macrotech Developers And Brigade Enterprises Most of the money was raised through this route.

“The strong QIP activity highlights the important role of the sector in India’s broader capital markets and the growing confidence of institutional investors in Indian real estate,” said Anuj Puri, Chairman, ANAROCK Group.

QIP allows publicly traded companies to raise capital by offering equities or securities convertible into equity to pre-approved institutional buyers.

Strong growth in housing sales following the pandemic has led major developers to launch inventory across markets. According to ANAROCK Research, more than 13.62 lakh units were launched across the top seven cities between the first nine months of CY21 and CY24.

Housing sales in these cities increased to 14.36 lakh units during this period. Despite the high rate of supply growth, unsold housing inventory declined by more than 10 percent due to strong sales during the period.

“To finance their aggressive expansion, these developers are turning to the IPO and QIP route,” Puri said. “Their success in these capitalization efforts underscores the sector’s continued ability to attract both retail and institutional investors. We hope that investor participation will increase manifold in the coming years.

The Nifty Realty index gained nearly 250 per cent between January 2021 and September 2024, making it the second best performing sector index after the Nifty PSU Bank index.

Strong demand from homebuyers post the pandemic has also prompted developers to raise funds through IPOs to launch new projects across geographies. From 2021, six developers, Macrotech Developers, Shriram Properties, main principleSignature Global, Suraj Estate and Arcade Developershave collectively raised ₹5,275 crore through mainstream IPOs. Macrotech Developers has raised around Rs 2,500 crore.