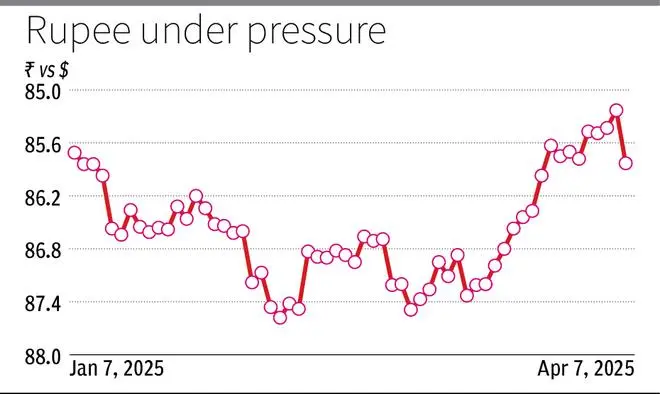

The rupee closed at 85.8350 per US dollars against the previous bandh of 85.2350. , Photo Credit: Leovolfurt

Rupee To end at a two -week low of two -week low as a mutual tariff of US President Donald Trump, it dropped 60 money, declining in about three months, sang in global financial markets including Indian equity markets.

The Indian unit came under pressure as the FPI hit the cell button in domestic equity markets amidst selling in global markets. Foreign (Custodial) banks bought dollars from FPI to remove sales income.

Some relief

The fall in crude oil prices and a weak dollar made much less to promote the rupee. This weakened due to a demand for heavy dollars from FPI customers of foreign banks.

The rupee closed at 85.8350 per US dollars against the previous bandh of 85.2350. The rupee opened 35 money below 85.59, indicating the depreciation trend in the Non-Dilivable Forward (NDF) market.

Tamil Nad Mercantile Bank, Executive Vice President (Treasury), Arvind Kanagasbai said: “Whenever a major accident occurs in the market, the money will be withdrawn from the way to the outflow of FPI.

“The shares of all export-oriented companies have fallen today. It indicates that imports will continue, dollar flows will also decrease. Therefore, overall trade deficit will be widened. The market players must have started covering based on this assessment. Therefore, the money weakened.”

He noticed that American importer would re -interaction the export contracts

Feed our eyes on us

Acuité Rating and Research, MD & CEO, Sankar Chakraborti, said that if the US Federal Reserve proceeds with a cut in the rate, it can reduce the pressure on the Rupee, allowing RBI to get more space for additional rate reduction.

Sonal Badhan, an economist at the Bank of Baroda, observed that the present year could be marked on the basis of instability on the currency front, which is waiting for clarity on the US tariff policies. This will also determine the stage for the rate of Fed, in turn it will affect how the dollar behaves.

On the domestic front, Rupee is likely to gain support from growing prospects, low inflation and improving stable exterior deficit. Overall, Bob’s Economics Department hopes that FY26 will have a trade of rupee to trade within the range of 85.5-87.5.

more like this

Published on 7 April 2025